Successful CRM Requires Good Structure and Right Vendor Partnership

Most businesses know their customers need but fall down miserably because their customer service, sales and marketing efforts are not well structured. A CRM system provides the necessary structure, but the company needs to ensure it integrates the right CRM software and has the right implementation partner.

Credit unions are concerned about getting success during CRM implementation. They have reservations since study shows an average 40-60% failure rate on CRM projects. However, the best thing is, you are free to make the right choices early on to take your credit union to success stage.

When working with an experienced and highly engaged vendor, you can save many CRM projects from failing. Indeed, recent study shows that a clear strategy and experienced vendor are the keys to high rate of adoption and satisfaction with credit union CRM. Continue reading to learn how the right partner can ensure a successful CRM.

Begin by Goal Setting

If you cannot measure what CRM success will look like, it is difficult to determine whether your implementation is going well, or whether you need to do some sort of correction. Do you want to track the sales parameters? Are you finding your customer satisfaction score or operational data? And, how your baseline looks like?

A proficient vendor will assist you to identify the metrics that is important to your credit union, so you can get a good indication of your CRM journey, and plan future fine tuning as well.

Confirming User Adoption

It is no wonder that in the recent research, many leaders of credit union cited ease of use a key requirement for the CRM. It goes without concern that how many bells and whistles may have in this new technology. If your staff fails to use it consistently across the organization, your CRM project will mail miserably to meet expectations.

Your vendor should help in this aspect by encouraging adoption not only through training, but also by sharing and exchanging tips and tricks to increase adoption rates. A holistic adoption strategy is one that includes everything from CRM champion programs to departmental challenges. Make sure you ask your vendor what their credit unions have done to make the adoption fun and interesting.

Handling the Integration Process

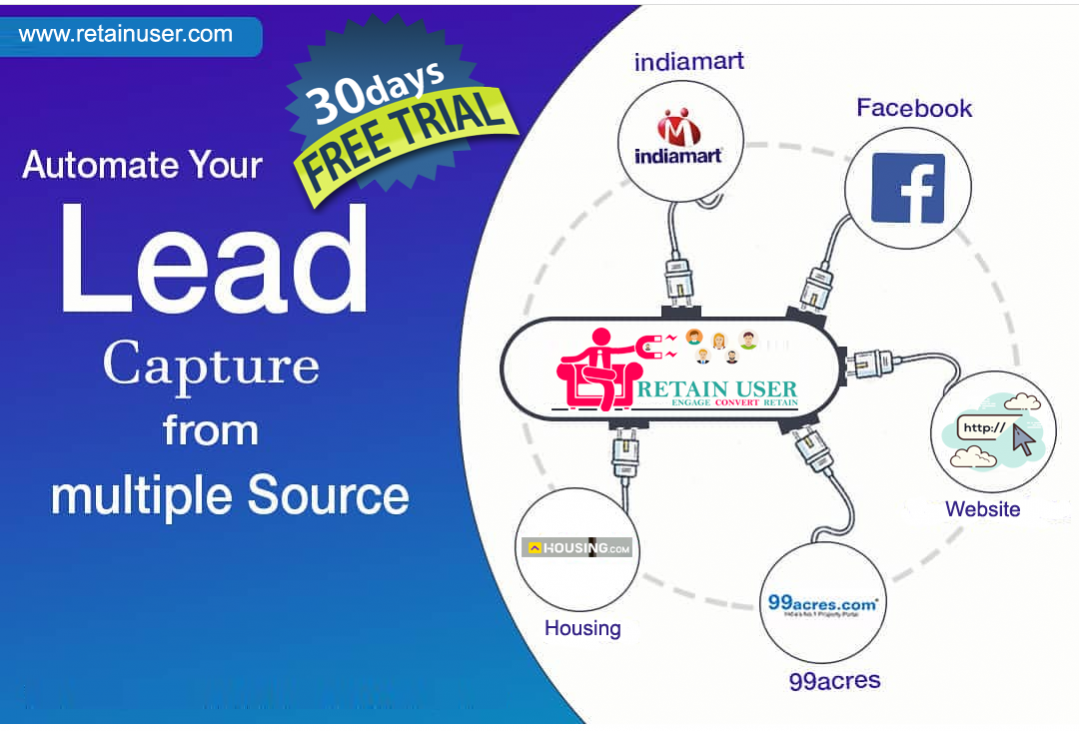

For a CRM integration process to be valuable across the entire organization, it needs to be well-integrated with data source and third-party systems to fine-tune with the process. Otherwise, what you can do is to wind up with another limited point solution instead of a central repository of member data.

Your vendor will assist you in the integration process, so you can save yourself to start from scratch. Vendors having experience in this particular industry should also have a well-defined process for building new integrations, and they can offer guidance on prioritizing CRM integration, and other tasks like data sanitization that should be completed first.

User Groups

It is common to be get swayed by the marketing outreach when it comes to select CRM. But make sure you remember to consider the benefits of a CRM in the credit union industry as well. A focused CRM may offer touchpoints like customer advisory boards and user groups, at which you can come in contact with your peers who may have the same challenges that are particular to the credit union industry. Make a thorough understanding and learn how they are using CRM to avail the best advantage, and even offer necessary suggestions on the product roadmap based on the changes that have been introduced in the industry.

Vendor Collaboration for Increased Chance of Project Success

We all know that CRM implementation is a complex process, but it shouldn’t be daunting. A proficient and experienced vendor has seen the steady progress through before, from scoping to successful adoption.

Early communication with the vendor means support throughout the CRM project. As you accomplish scope assessment and goal setting, during implementation and as you set up the CRM, consider that you ensure adoption. The perfect CRM vendor will play a great role in your success, so take the time to truly understand the needs of your credit union, review proposal and select the right technology partner.

Leave a comment