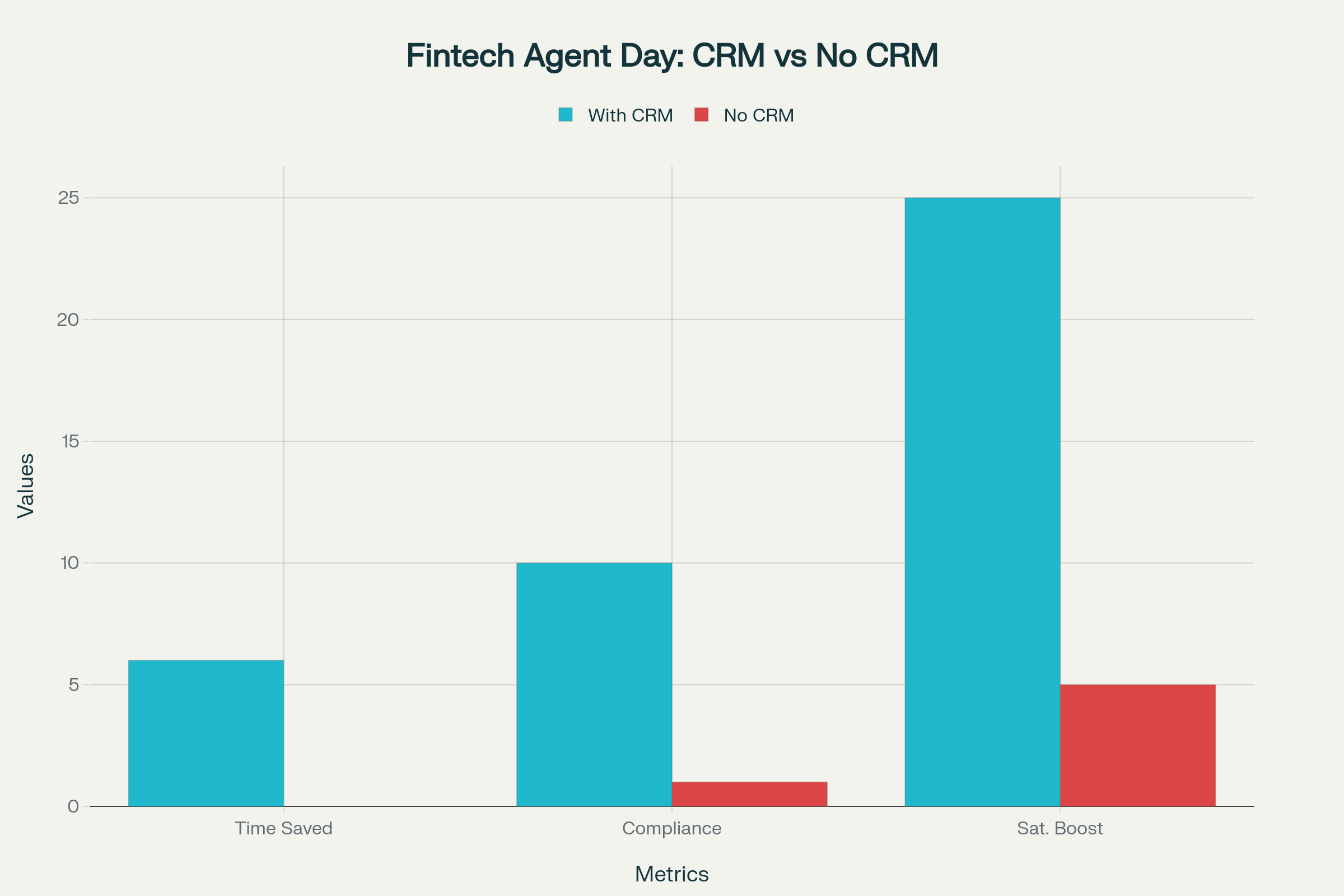

Before we dive in, here’s the bottom line: fintech firms that implement a dedicated customer-relationship-management (CRM platform outperform rivals that rely on ad-hoc spreadsheets or disconnected point solutions. They capture more revenue, cut compliance risk, and keep customers loyal in an era when a swipe can send them elsewhere. Firms that stick with manual processes lose deals, leak data, and struggle to scale profitably.

The FinTech Customer-Experience Mandate

Digital finance lives and dies on trust and immediacy. Consumers expect 24/7 onboarding, personalized product offers, and friction-free support. That means each interaction—whether a KYC check, a payment dispute, or a robo-advice alert—must be logged, routed, and resolved in seconds.

Market reality: 91% of companies with 11+ employees already use a CRM, and financial services now account for one of the fastest-growing verticals in the CRM market.

Growth stakes: Businesses that deploy CRM Software increase sales by up to 29% and improve retention by 27% on average.

Competitive pressure: The global financial-services CRM market is projected to triple from $15 billion in 2025 to $45 billion by 2033 as cloud and AI capabilities mature.

Life With vs. Without a FinTech-Grade CRM

Four Hidden Costs of “No-CRM” Operations

Missed Sales Opportunities: Firms that delay follow-up by even 30 minutes are 21 × less likely to qualify a lead. In some studies, 73% of inbound prospects never receive any contact at all.

Inefficiency and Burnout: Reps waste 5–10 hours per week on manual data entry or report prep when no unified platform exists. That lost time equates to higher payroll and slower growth.

Regulatory Exposure: Fragmented records complicate AML, PCI-DSS, and GDPR audits. Non-compliance fines can wipe out years of margins, while a single breach torpedoes brand equity.

Poor Forecast Accuracy: Without consistent pipeline data, treasury and risk teams fly blind. One major bank scrapped a £10 million CRM replacement only after analysis showed churn risk would rise under the patchwork approach.

Seven Must-Have Features in a FinTech CRM

Secure, Cloud-Native Architecture for rapid deployment and encryption-at-rest.

Automated KYC/AML Workflows that embed ID checks, PEP screening, and audit trails.

Real-Time API Integrations with core banking, payment gateways, and credit bureaus to create a single source of truth.

AI powered whatsapp chatbot for automation.

Role-Based Access Controls satisfying SOC 2, GDPR, and regional data-residency rules.

Omnichannel Communication Hub covering chat, email, voice, and in-app messaging with automatic logging.

Low-Code Workflow Builder so ops teams can iterate processes without heavy IT involvement, accelerating product launches.

Implementation Tips to Maximize ROI

Define Two or Three High-Impact Use Cases First—e.g., automated onboarding or cross-sell campaigns—and measure them ruthlessly.

Clean & Map Data Before Migration. Dirty imports sabotage user trust and reporting accuracy.

Involve Frontline Teams Early. Banks that co-design workflows with relationship managers report far higher adoption.

Integrate with Core Systems Out of the Gate. A consistent “single customer file” prevents double data entry and speeds adoption.

Phase Rollouts and Provide Micro-Training. Short, use-case-driven sessions beat marathon tutorials and keep momentum high.

FinTech is fundamentally a data business. Without a purpose-built CRM, you’re gambling that spreadsheets and siloed tools can keep up with hyper-growth, rising regulation, and sky-high user expectations. The evidence is clear: firms that invest in an integrated, AI-ready CRM platform close more deals, safeguard compliance, and delight customers—while those that don’t bleed revenue and reputation.

Ready to Retain, Delight, and Scale?

Harness all the power you’ve just read about with RetainUser FinTech CRM Software—a fintech-optimized, compliance-ready platform that unifies your leads, transactions, and support in one intuitive workspace. Move from spreadsheets to smart workflows in weeks, not months, and watch customer lifetime value climb. Start your free trial of RetainUser today and turn every user into a lifelong customer.

How WhatsApp Chatbots Are Redefining the Real Estate Industry

From Inquiry to Enrollment: CRM’s Role in India’s Digital Education Revolution

![]() Free Integration

Free Integration

![]() Free On-Boarding Call

Free On-Boarding Call

![]() Free Integration

Free Integration

![]() No Hidden Cost

No Hidden Cost